SaaS Pricing Models for Product Managers

6 ways to price your SaaS product using leading SaaS businesses as inspiration

Pricing a product is a critical part of product management; it’s rarely something product teams will or should do themselves and will typically involve a blend of product, marketing and sales. Most parts of the business will care about the price of your product. And rightly so.

Let’s say you’re a member of a product team working on a SaaS product and you’ve been tasked with leading an overhaul of your pricing strategy, or you’re just interested in product pricing more generally. Where exactly do you start?

We looked at some of the top SaaS companies and examined how they price their products so that you don’t have to. You can use this as a way to guide your own pricing strategy by examining what the market is doing and how you might tailor these models to suit your own product.

SaaS companies profiled

Here’s a snapshot summary of the key findings from our analysis of SaaS companies profiles.

SaaS pricing models – key findings

- Feature based tiers with scaled pricing based on volume usage is the most popular pricing model

- Time based trials aren’t as popular as they once were – 75% of the SaaS companies profiled don’t use them as their primary pricing model (some companies will offer a freemium model with a free trial of premium features, for example)

- Transactional fee models are primarily used by payments companies

- A pay annually option alongside a pay monthly option is offered by most SaaS companies now

- Secrecy – some companies remain coy about their pricing and show no pricing upfront

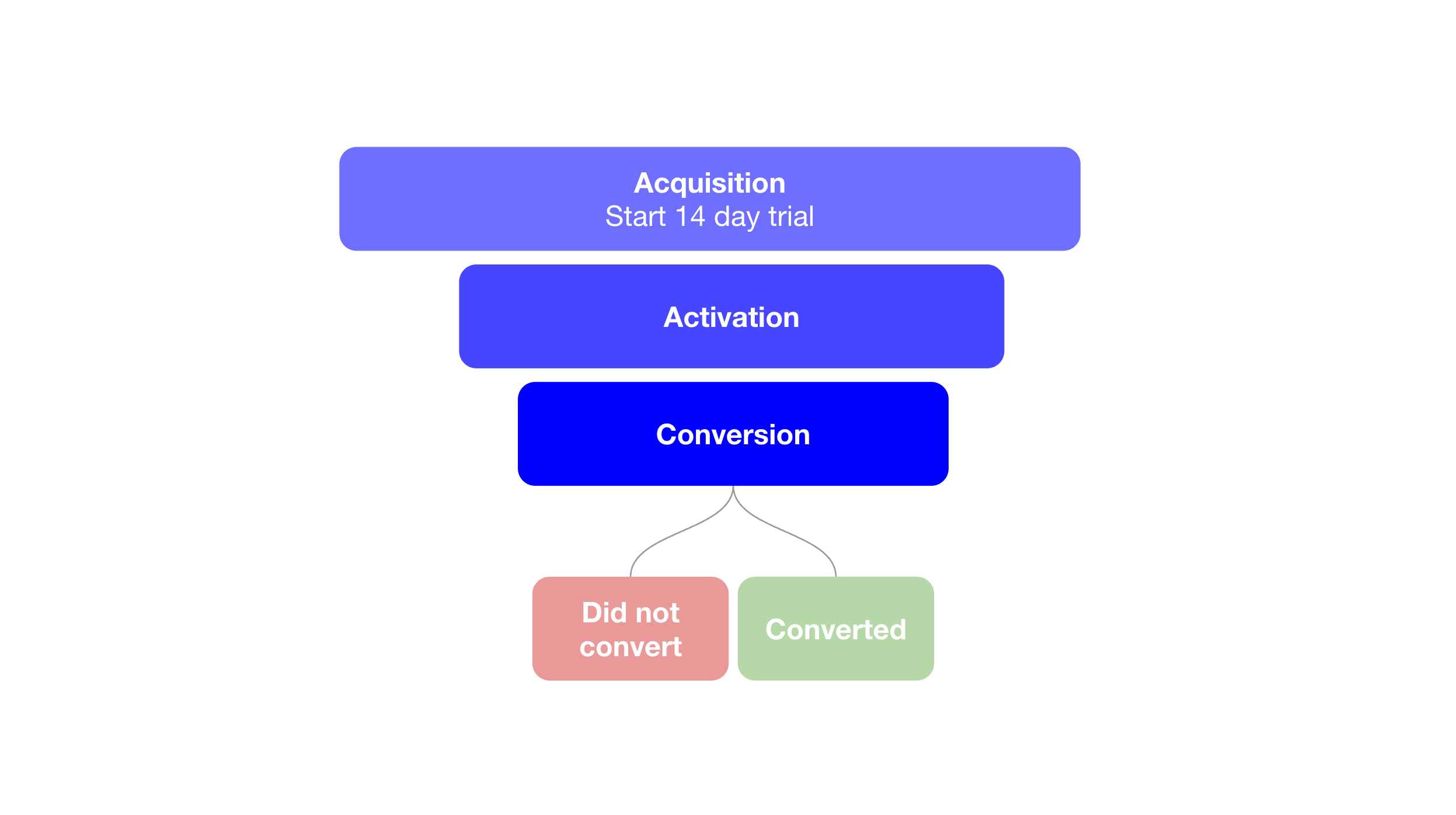

1. Time based trials

There was a time when almost all SaaS products operated with a time based trial model. You’d sign up for a trial, get full access to all features and then either cancel if you didn’t like it or roll over to a fully paid contract if you did.

For product teams, this model presented a couple of challenges, with perhaps the biggest ones being:

- Activation – failure to convince users to activate and get value out of the product in such a short space of time – why bother investing time and effort if you’re going to lose access in 14 days anyway?

- Conversion – failure to convert 14 day trial users into paying customers

- Payment friction – Failure to persuade users to provide payment card details up front in order to automatically roll onto a paid for plan once the trial had ended

This often left product teams frustrated and searching for alternative ways to increase engagement and conversion in those first critical 14 days.

Now, however, it looks like time based trials aren’t quite as popular as they once were. Bearing in mind we only picked 20 companies at random, there could quite well be plenty of selection bias involved here, but there does seem to be a broader trend away from traditional 14 day trials and onto other, more efficient ways of offering a taste of a SaaS product.

If you’re considering introducing a time based trial pricing model for your SaaS business, think about how you might address the challenges of activation, conversion and payment friction up front and whether there might be alternative models that could work better.

2. Feature based tiers

Along with scaled pricing by usage volumes, feature based tiering is by far the most popular pricing model for SaaS products right now.

You know the drill, you get a set of features either for free or for a low cost and for each more expensive package you get a bunch of new, additional features. If we compare this approach to time based trials, you can see why this might be a more successful approach.

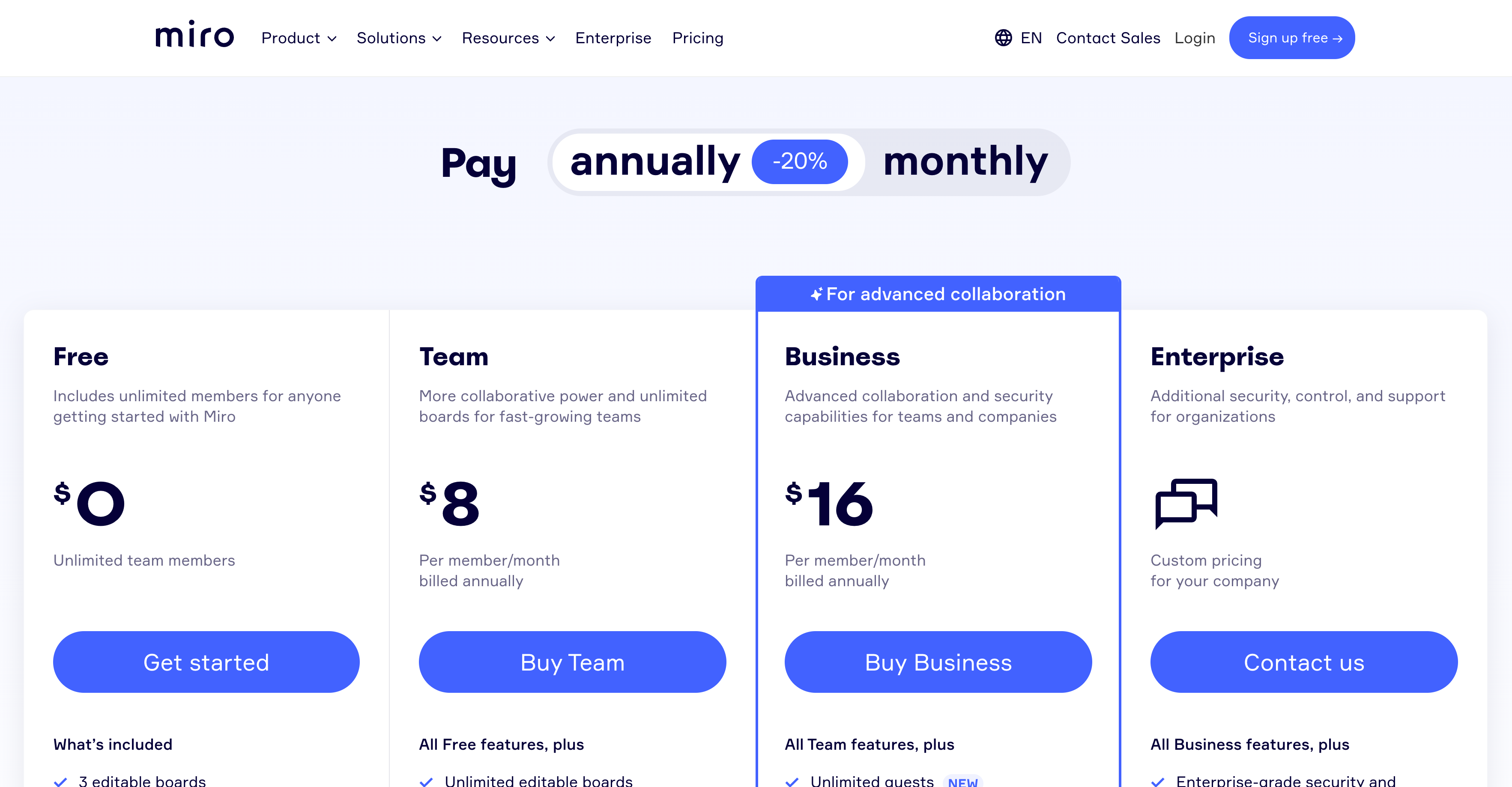

Example – Miro

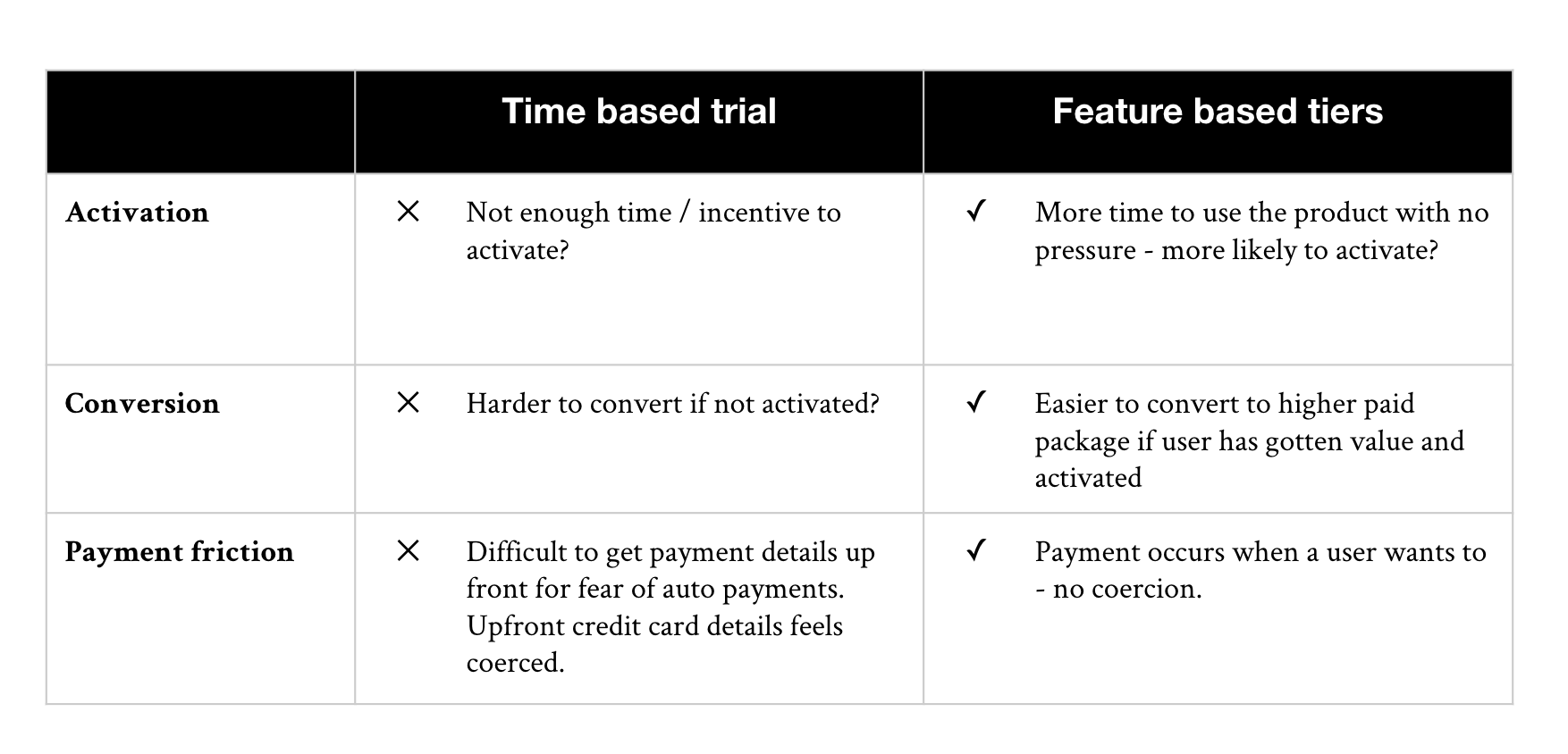

Time based trials vs. feature based tiers – a comparison

- Activation – with no looming 14 day deadline and a free offering for a lifetime, it makes more sense for a customer to give the product a proper try. Sure, the deadline of a 14 day period obviously instils some urgency but the niggling feeling that you might not pay for it at the end of the period could make people less likely to invest their time into it. With a free offering, you can happily invest time and energy into it knowing that you’ll continue to keep access. This gives the product a chance to shine (albeit in a limited way) which could then lead to a decision to upgrade.

- Conversion – free tier access gives customers the opportunity to actually use the product with no pressure. This means they are potentially more likely to get value out of it and therefore decide themselves to convert into a paying customer. They may reach a specific threshold e.g. limited team members or number of actions permitted and this could prompt them to convert.

- Payment friction – in this model, nobody is asking users to provide credit card information up front. A user will choose to pay once they’ve seen enough value in th product based on their limited usage. The low / free tier acts as a trial in itself, without the stress of a 14 day window, after which all access is lost.

All users are customers (even the free ones).

Feature based tiering also makes the customer feel like they’re actually a genuine user of your product, even if they haven’t paid. In a trial model, the folks who decided not to continue with a free trial are almost treated as the bad guys; the outsiders who made the wrong decision.

Sometimes, marketing teams will bombard them with emails to say ‘oh it’s never too late to join us! You can redeem yourself by clicking here and giving us your money’. This is obviously a little off putting and the beauty of a feature based model is that all users – whether free or paid – can be treated as customers.

If you can build a product which proves that free users will engage regularly with it, this could lead to high NPS scores, referrals and positive word of mouth which create more paying customers further down the line. Nurture your free customers and you’ll reap the benefits later on.

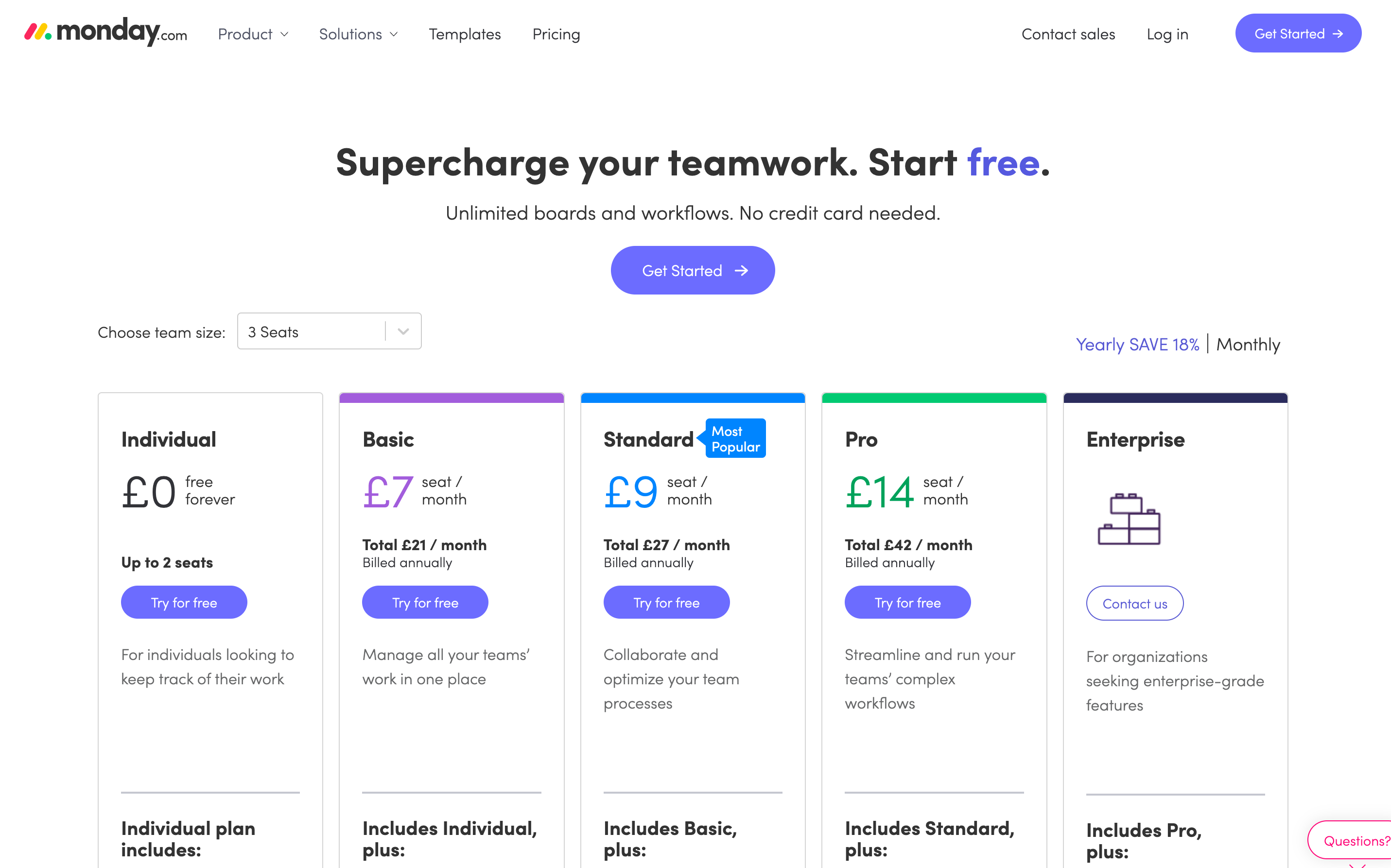

3. Scaling by volume

This model allows you to be up front with the user and let them know that their access is limited by the volume of actions performed in a given period (typically monthly).

It takes time to figure out what each of the thresholds should be, but scaling pricing based on volume is usually seen as a fair approach to pricing since it ensures that smaller companies aren’t penalised, or asked to pay the same price as a larger enterprise.

By linking usage volume to price, the assumption is that if companies are large enough to perform high volumes of actions, they’re also cash rich enough to be able to pay for it.

Example – Monday.com

How do you decide what features should be included in volume pricing?

Clearly, not all features should be included in a volume based pricing model. If you were to include registration transactional emails as a lever in deciding package pricing, that would be odd.

Consider a few factors:

- Value – does the feature link neatly to your own value proposition? If I’m signing up for an email sending provider, for example, I’d expect some of the features used in volume-based pricing to include number of emails sent or number of contacts on my client list.

- Cost to serve at scale – does this particular feature cost you, as the SaaS product, more to serve as the company scales its usage? Ideally, anything that costs more for you to serve should be included in your pricing calculations and factored into different packages.

- Indicator of company growth – does an increase in usage of this feature indicate that the end customer (the user) is growing? If they are growing, this gives you the opportunity to capture more value from their growth too, by charging more.

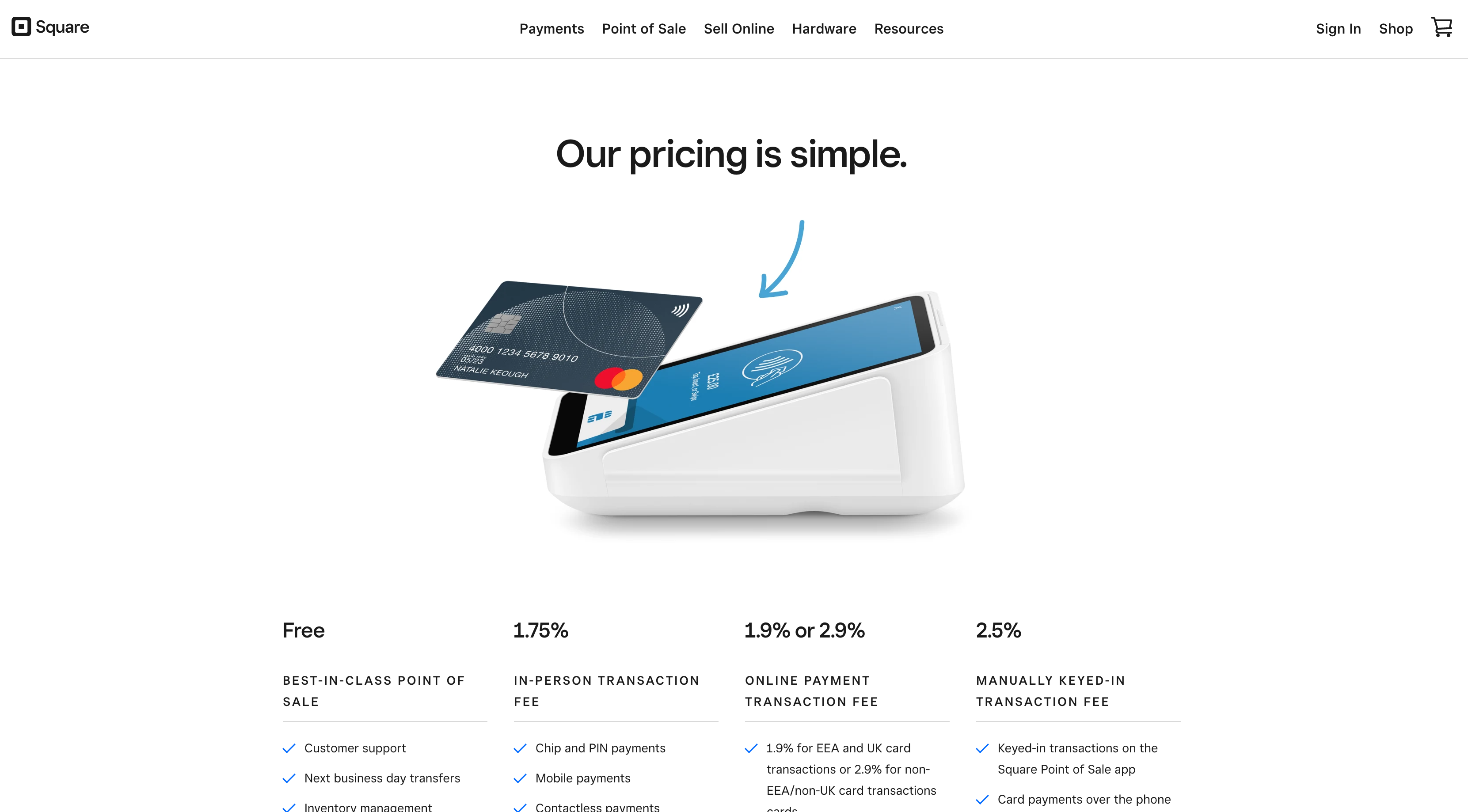

4. Transactional commission fees

This model says ‘OK, use our product for free, but we’ll take a percentage of each transaction’.

This model is perfect for products where the action is repeatable, predictable, scalable and commissionable such as payments.

Example – Square

Square offers POS software for free but charges a fixed percentage on each transaction.

Stripe offers its payments software platform for free but charges a fixed percentage on each transaction too.

Twilio does the same.

If you have repeatable, predictable and scalable transactions that are commissionable in this way, you might want to consider a transactional fees model.

It makes sense in payments, but perhaps there are other opportunities to introduce this type of pricing model in products where you wouldn’t necessarily expect it. You just need to ensure the action is commissionable and a payment transaction is the easiest.

Imagine:

- An email platform or CRM that is completely free, but you’re charged a % on each sale made from email marketing.

- Slack charges takes a commission from every payment made via a link shared in a message

- Shopify offers its software for free but charges a 5% commission on every product sold.

Some of these make sense, others don’t.

5. Build your own (+add ons)

In the group of SaaS products we looked at, 45% of them offered a way for customers to build their own pricing.

This is a rather sophisticated way of modelling your pricing structure and is more suited to established businesses who are able to facilitate more complex pricing structures such as this.

One of the most common ways to allow customers to build their own packages is through packages and add ons.

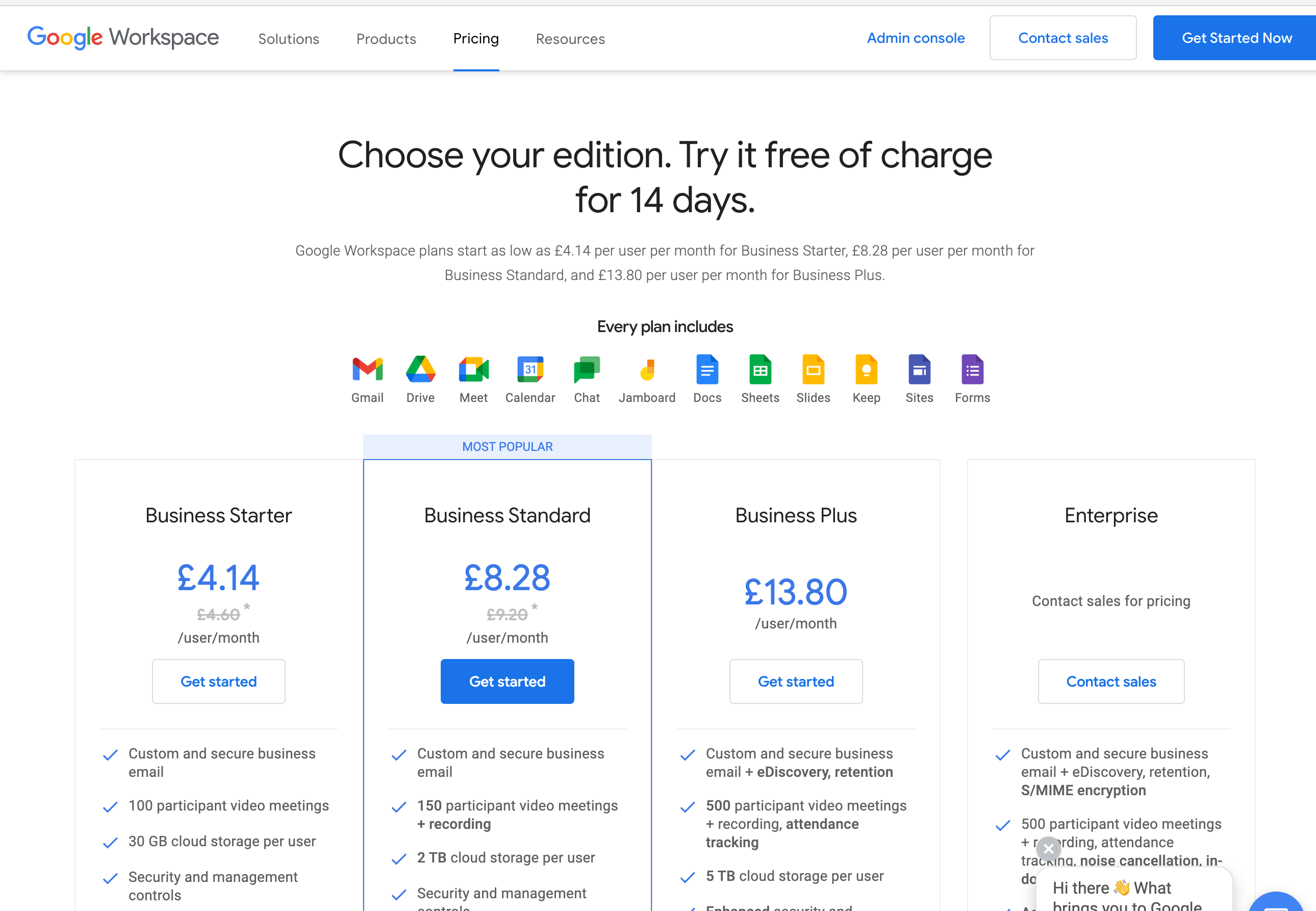

Example – Google Workspace

Google Workspace gives customers the ability to add on additional features and services to their product, such as hardware for example.

HR management platform Gusto also offers a way for customers to include add ons for additional services such as healthcare.

These build your own packages can work a treat in allowing customers to tailor the product exactly to their needs. Rather than shoehorning them into a pre-existing package, add-ons allow customers to pick and choose what they want – and the overall experience feels (and is) far more tailored.

If you’re considering adding add ons into the mix, think carefully about why they should be classed as an add-on and not factored into your tiered packages.

When should a feature or product be categorised an add-on?

- Uniqueness – is the product or service unusual or unique enough that it stands out from the rest of your product feature set to justify a category of its own? Google Workspace’s office hardware for example, is a unique feature when compared to the software (Docs, Sheets etc) offered as part of its core WorkSpace product.

- Cost to serve – does this product or feature have an especially high cost to serve that would distort the package price if bundled into a standard package? Add-ons are usually prohibitively expensive to bundle into a core package and this is one of the reasons they are often considered as standalone add-ons instead.

- Broad appeal – does the add-on have broad appeal that would penalise customers if it were only available in a higher tiered package? In the Gusto example, imagine a small business wanted to add healthcare into their service but had to upgrade to an enterprise level package to do so. It would unfairly penalise the company.

6. Secret pricing (available on demand)

What if you were to keep the price of your product a secret? The final most common SaaS pricing model was only found in one SaaS company we profiled (WorkDay).

This model is largely reserved for enterprise software that is so complex and unique from customer to customer that it makes little sense to offer packages at all. Instead, in this model, the prices are kept from the customer until they request more information. After this point, a sales agent will usually reach out to get in touch for further information.

This model isn’t common and it deprives the customer of transparency. Perhaps it works for larger enterprises but there may be a big downside in the potential for lost customers who try to find the price and leave when they can’t.

Which pricing model should I choose for my product?

Only you and your team can decide which model might work best for your product. This is meant to provide you with some inspiration but there’s no reason why you can’t create your own pricing structure that is unique to your business.

You can also experiment with different pricing models through user testing. Conducting real world pricing model changes is notoriously difficult since it usually requires a bunch of governance and technical changes to implement so user testing and research might be a better option.

How to user test pricing model ideas

In a user testing session, you could show a potential (or existing) customer some new landing pages with the packages and models you’ve outlined and ask them to imagine that they are in the market for purchasing this type of product.

Probe them with questions about what’s important to them, why they might prefer one model over another and then ask them to complete the signup journey.

This way you can test both the model itself (does the structure of the model fit the needs of the business) and the usability of the designs (can a user easily purchase a product using the designs suggested for this pricing model.

Principles to follow when building your own SaaS pricing model

- Simple, easy to understand – is the model simple and easy to understand? When product teams get too excited, they end up creating Frankenstein’s pricing monsters. Even if there is complexity to your product (and your pricing), keep things as simple and easy to understand as possible. Ways to keep things simple could include: hiding unnecessary clutter from the pricing pages, naming packages in simple ways and optimising for the most common users. If you know 90% of your customers are small businesses, don’t optimise your landing pages for enterprise customers, unless you’re planning a strategic shift to focus on them.

- Opportunity for activation – does the model give the customer the opportunity to try your product enough so that they can ‘activate’? Product activation is the point at which a user uses the most fundamentally valuable part of your product. For a HR management platform this could be adding employees and booking holidays. For a payments platform this could be performing the first payment. The pricing model should allow users to get to the product activation stage easily.

- Fair – is the model fair? Fairness can span across many aspects of your product and can include:

- Price – is the price prohibitively expensive?

- Policies – is there a returns policy?

- Features – are the features offered in the lower tiers so useless that they aren’t worth trying?

Pricing isn’t easy, and it is underpinned by a valuable product.

Whilst product teams will inevitably be involved in pricing discussions, the value that the product delivers is still the most important aspect that product teams should focus on. After all, if the product isn’t offering anything valuable in the first place, it won’t matter. Even with the smartest pricing model in the world.